Building Financial Confidence Since 2018

We started iroqentloex because too many smart people were making expensive money mistakes. Not from lack of intelligence, but from lack of practical financial education that actually works in real life.

Why We Exist

Back in 2017, I watched my brother-in-law lose ,000 trying to flip houses without understanding cash flow. He's an engineer—brilliant guy—but nobody ever taught him how money actually moves through property investments.

That's when it hit me. We don't have a smart people problem. We have a practical education problem. Schools teach calculus but not compound interest. Universities cover theory but skip the stuff that breaks budgets in the real world.

So we built iroqentloex to fill that gap. Real financial education that prevents expensive mistakes before they happen.

What Drives Our Work

These aren't corporate buzzwords on our wall. They're the principles that guide every program we create and every client conversation we have.

Real-World First

We test everything in actual financial situations before teaching it. If a strategy doesn't work when your car breaks down and you need ,000 next week, we don't recommend it.

No Perfect People

Our programs work for people who sometimes overspend, forget to track expenses, and make emotional money decisions. Because that's most of us, and pretending otherwise helps nobody.

Honest About Limits

We can't make you wealthy overnight or guarantee investment returns. What we can do is help you avoid the costly mistakes that set people back for years.

Education Over Sales

We don't sell financial products or earn commissions on recommendations. Our only business is teaching people to make better money decisions for themselves.

Meet Our Founder

iroqentloex started as a side project and grew into something that's helped over 2,800 people make smarter money decisions. Here's the person behind it all.

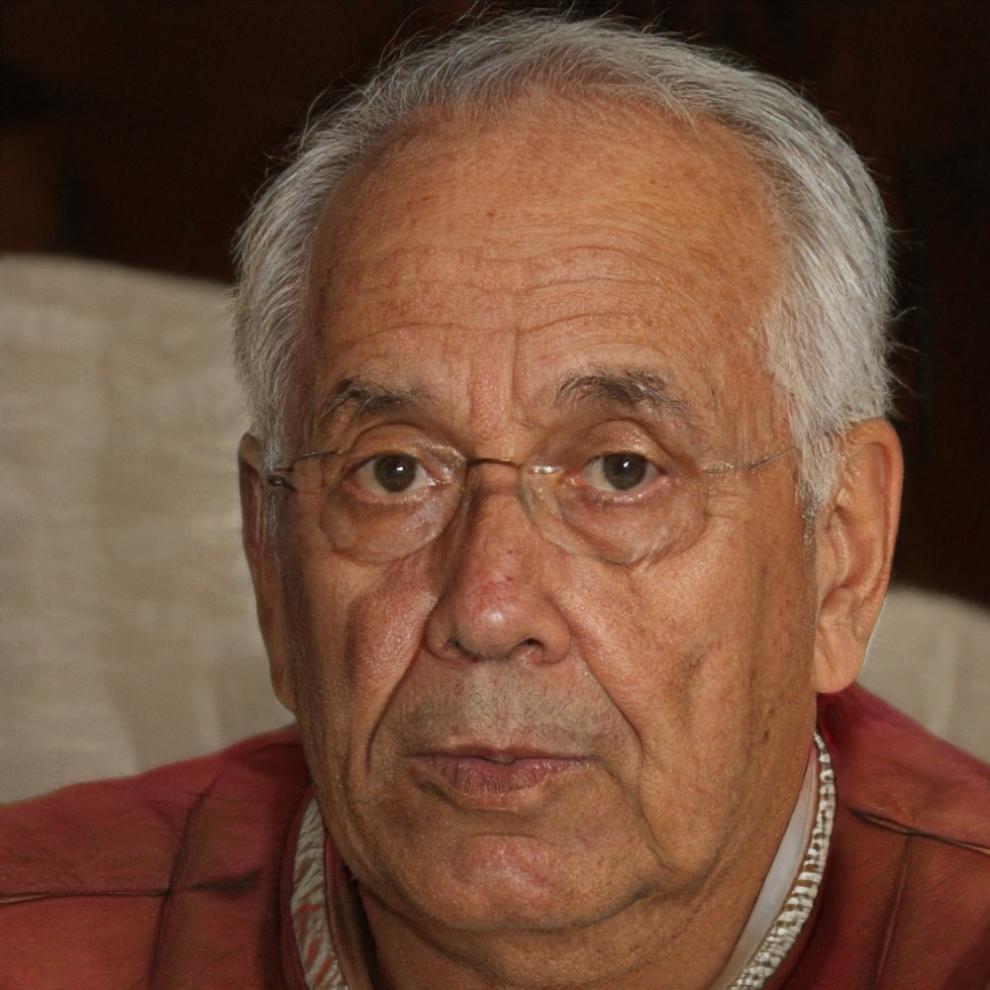

Marcus Thornfield

Founder & Lead Educator

Background

Started in corporate banking for eight years, then spent five years as a financial advisor. Saw too many people making the same expensive mistakes over and over, usually because they'd never learned the basics.

Left traditional finance in 2018 to focus entirely on education. Sometimes people think I'm crazy for giving up commission income, but this work actually matters.

Teaching Philosophy

Financial education should be practical enough to use next month, not theoretical enough to win academic debates. I focus on the 20% of concepts that solve 80% of money problems.

And honestly? Personal finance isn't that complicated once you strip away all the jargon and product sales pitches.

Our Approach Today

We run small group workshops, one-on-one coaching sessions, and online programs. Everything is designed around real scenarios and practical application.

Our next workshop series launches in September 2025, covering everything from emergency fund strategies to investment basics that actually make sense.